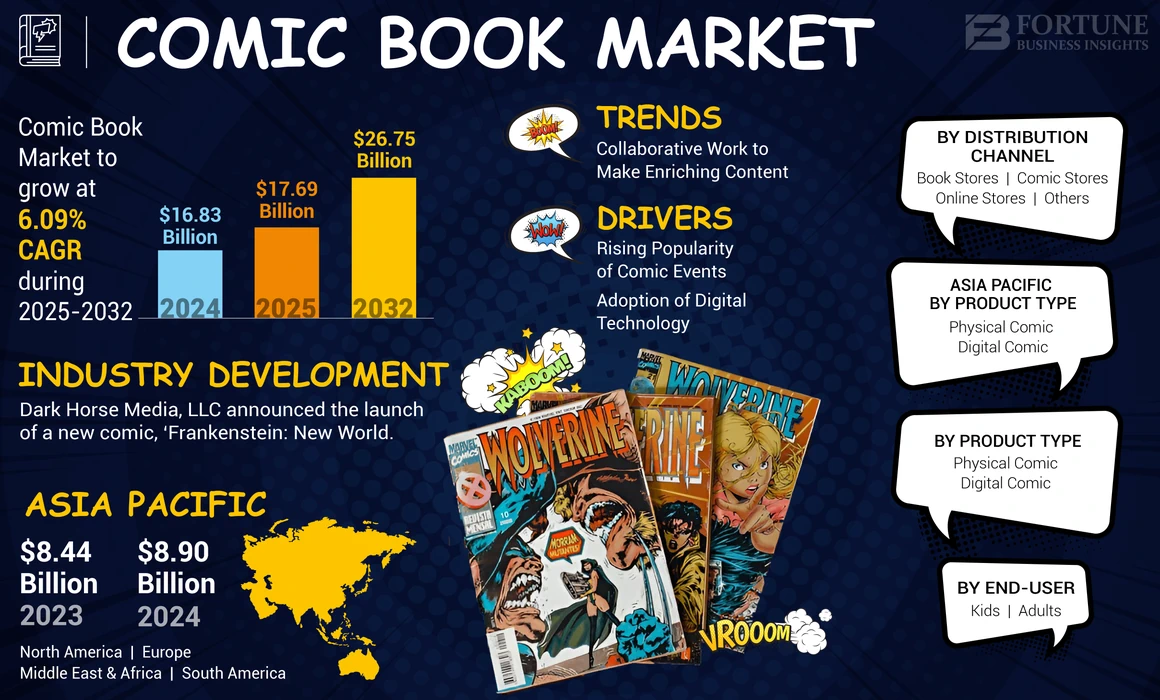

The comic book industry has grown from niche fan culture into a global entertainment powerhouse, capturing readers across generations. With the rise of superhero franchises, anime, and digital comics, comic books have become a vital part of global pop culture. According to the latest research, the global comic book market size stood at USD 16.83 billion in 2024, is projected to reach USD 17.69 billion in 2025, and is forecasted to expand to USD 26.75 billion by 2032, at a CAGR of 6.09% during 2025–2032.

Asia Pacific currently leads the market, accounting for 52.88% of global market share in 2024, thanks to the thriving anime and manga ecosystem in Japan, South Korea, and China. Meanwhile, the U.S. comic book market is expected to reach USD 4.41 billion by 2032, driven by the popularity of Comic-Con events and superhero launches.

Request FREE Sample PDF Copy of Comic Book Market: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/comic-book-market-103903

Why Comic Books Remain Popular

Comic books are no longer just children’s entertainment—they are a creative medium that combines storytelling, art, and culture. Their popularity stems from several factors:

- Engaging narratives and artwork: Readers are drawn to colorful illustrations and immersive stories spanning genres such as fantasy, sci-fi, noir, romance, and adventure.

- Educational value: Comics improve vocabulary, foster creativity, and deliver strong values through positive storytelling.

- Cultural significance: From Japanese manga to Marvel and DC superheroes, comic books are deeply tied to cultural identity and modern entertainment.

Even governments are recognizing their value. For example, India’s Ministry of Education launched 100 educational comic books in 2021 to encourage children to read and learn creatively.

Market Growth Drivers

1. Comic-Con Events and Fan Culture

Events such as San Diego Comic-Con, New York Comic-Con, and Japan Comiket attract hundreds of thousands of fans annually. These gatherings not only boost comic sales but also strengthen global fan communities. Brazil’s São Paulo Comic Con Experience (CCXP) alone attracted over 260,000 visitors in 2021, highlighting how large-scale conventions fuel demand.

2. Smartphone Adoption and Digital Comics

The rise of digital comics is fueled by global smartphone penetration. According to IDC, smartphone shipments rose by 73.6 million units in 2021 compared to 2020. With more readers accessing comics via apps and e-stores, digital editions are gaining momentum, especially among younger audiences.

3. Collectors and Rare Editions

Comic collecting has evolved into a billion-dollar niche market. Rare issues are sold at auctions for massive profits, motivating fans to invest in limited editions and vintage comics. This trend supports growth in both physical and digital formats.

4. Cross-Media Collaborations

Publishers are increasingly collaborating with brands, streaming platforms, and tech companies to expand reach. For example, Marvel partnered with VeVe in 2022 to launch NFT-based Spider-Man comics, appealing to digital collectors and blockchain enthusiasts.

Market Segmentation Analysis

By Product Type

- Physical comics: Still dominant, supported by collectors and auction markets. Cover appeal, nostalgia, and limited editions make physical comics highly valuable.

- Digital comics: Growing rapidly with e-books, apps, and online platforms. Countries like Italy reported a 63% increase in digital comic releases in 2020.

By End User

- Adults: The largest segment, driven by collectors and hobbyists. Adults often buy comics as investments and as a creative escape.

- Kids: A fast-growing segment, as comics improve reading skills, vocabulary, and creativity. Governments and schools are increasingly adopting comics as educational tools.

By Distribution Channel

- Bookstores and comic shops: Still the backbone of the industry, providing curated experiences for fans. The U.S. has around 2,000 comic shops, boosting sales of both new releases and collectibles.

- Online platforms: Expected to grow steadily, offering convenience, home delivery, and exclusive editions. Digital payment apps and global e-commerce platforms further fuel this channel.

Regional Insights

Asia Pacific – Market Leader

The region accounted for USD 8.90 billion in 2024, led by Japan’s manga industry, which dominates both domestic and global markets. South Korea’s webtoons and China’s digital platforms also contribute heavily to the region’s dominance.

North America – Home of Superheroes

With USD 88.81 billion expected by 2025, North America is the second-largest market. The U.S. benefits from its vast comic book stores, superhero movies, and iconic publishers such as Marvel, DC, and Dark Horse.

Europe – Creative Hub

Countries like France, Italy, and Germany produce 3,000–4,000 new comic titles annually. Rising youth readership and strong homegrown creators strengthen Europe’s position.

South America – Fan Conventions Drive Growth

Brazil is a hotspot thanks to Comic Con Experience (CCXP), the largest comic event in the world. These conventions also promote merchandise, games, and licensing opportunities.

Middle East & Africa – Emerging Market

Urbanization and increasing literacy rates, especially in South Africa, are fueling comic adoption. Mobile accessibility is driving readership among youth.

Key Trends Shaping the Comic Book Market

- Asia Pacific witnessed comic book market growth from USD 8.44 Billion in 2023 to USD 8.90 Billion in 2024.

- NFT Comics & Digital Collectibles: Marvel and other publishers are tapping into blockchain.

- Diverse Storylines & Inclusive Characters: Representation of different cultures, genders, and identities is on the rise.

- Cinematic Synergy: Blockbusters like Spider-Man and Black Panther boost global comic demand.

- Collaborations with Streaming Services: Archie Comics’ partnership with Netflix exemplifies how cross-media exposure increases readership.

Industry Challenges

Despite growth, the comic book market faces:

- Competition from substitutes such as audiobooks and online streaming.

- High production costs and fluctuating paper prices affecting physical comics.

- Counterfeit comics and piracy in digital formats.

Get Full Insights: https://www.fortunebusinessinsights.com/comic-book-market-103903

Competitive Landscape

The comic book industry is highly competitive, with top publishers investing in new characters, storylines, and cross-platform projects. Key players include:

- Marvel Entertainment, LLC (U.S.)

- DC Entertainment (U.S.)

- Dark Horse Media, LLC (U.S.)

- Archie Comics (U.S.)

- Image Comics (U.S.)

- IDW Media Holdings (U.S.)

- Akita Publishing & Futabasha (Japan)

- Rebellion (U.K.)

Recent launches highlight innovation:

- Marvel (2022): Introduced new titles like Ant-Man, Gambit, Iron Cat, and Wolverine: Patch.

- Dark Horse (2022): Released Frankenstein: New World in its Hellboy universe.

- Archie Comics (2022): Partnered with Netflix for a live-action musical.

- Rebellion (2022): Revived classic characters like Cat Girl and Black Beth.

Conclusion

The comic book market is evolving beyond traditional paperbacks, embracing digital platforms, NFTs, and cross-media storytelling. With strong growth expected, particularly in Asia Pacific and North America, the industry is set to thrive as both a cultural phenomenon and a lucrative business.

Publishers that focus on digital expansion, diverse narratives, and collector-driven editions will capture the next generation of readers while retaining loyal fans worldwide.

No responses yet